Hard Money Loan Requirements For Real Estate Investors

In real estate investing, timing and access to capital are crucial. They can mean the difference between a missed opportunity and a profitable venture.

Hard money loans offer fast, flexible funding. They help venture capitalists and real estate investors seize investment opportunities fast.

In the article, CS Financial Group Inc. will help you understand lenders’ wants in this article. We also explain how you can meet their criteria with ease and effectiveness.

Understanding Get a Hard Money Loan

What are hard money loans? Hard money is a shorter loan often secured by mortgage equity, which is real estate.

Unlike traditional mortgage lenders and banks, hard money lenders focus on property value determines.

While they may consider credit scores, they are not the primary factor in loan approval.

Key Characteristics of Hard Money Loans:

- Short-term, typically 6 – 24 months.

- Higher interest rates compared to traditional loans.

- Focus on property value over the borrower’s credit history.

- Faster approval and funding processes.

Property Requirements

1. After Repair Value (ARV)

Repair Value (ARV) is the key to getting a hard money loan. It’s the estimated value of your property after renovations are complete.

Here’s how it works:

- Expert Evaluation: To find the ARV, lenders use appraisals, sales data, and renovation plans.

- Loan Calculation: Hard money lenders typically offer 60 – 80% of the ARV. This means a $200,000 ARV could get you $120,000 – $160,000 in funding!

- Factors that Matter: The loan percentage can be affected by several factors. They are your experience, the property type, its location, and market conditions.

2. Loan-to-Value Ratio (LTV)

The Loan-to-Value (LTV) ratio is a major factor in securing favorable hard money loan terms. A lower LTV signals lower risk for lenders, which translates to better deals for you.

Specifically:

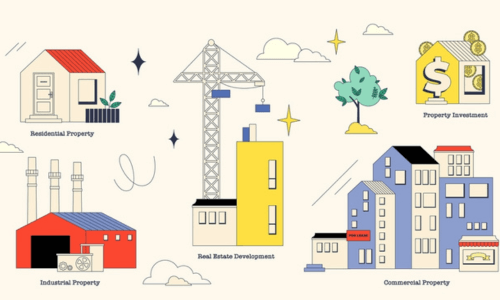

- Standard range of 65 – 75% LTV for residential properties.

- The standard range is up to 75% LTV for commercial properties.

- The standard range is up to 50% LTV for land loan investors.

While most hard money loans have LTV ratios between 65-75%, some lenders offer higher LTVs, even up to 90%.

Explore the possibilities of 90% LTV hard money loans at CS Financial Group Inc. and how they can benefit your real estate investment strategy.

3. Acceptable Property Types

Hard money lenders tend to offer loans for various property types:

- Single-family homes.

- Multi-family properties.

- Commercial real estate.

- Industrial properties.

- Land for development.

4. Property Condition and Location

Hard money lenders focus on a property’s potential. While they don’t expect a perfect property, its condition and location are key. These factors heavily affect loan terms.

Lenders will assess the property’s condition, planned improvements, location, and market demand. They also consider the potential for increased property value in the future.

Borrower Requirements

Lenders focus on the property. However, they can check borrower traits to ensure a fair partnership.

1. Credit Score

A credit score of 600 or higher can boost your approval chances and help you get better loan terms.

However, Hard money lenders are usually more flexible than traditional ones. They may lend to low-credit borrowers if other factors prove their repayability.

If you have credit issues, explore options with hard money lenders with no credit checks.

2. Financial Capacity

Borrowers need to prove that they have the funds necessary for:

- Down payment (typically 10-30% of the buy price and can vary).

- Closing costs are the extra expenses to complete the sale. They include fees for appraisals and legal paperwork.

- Reserve funds: Lenders want you to have extra money for unexpected costs, such as repairs or delays.

- Renovation money (if needed): If you fix the estate, you must prove you have the funds.

Having recent bank or investment account statements to prove your funds would be best.

3. Investment Experience

A strong real estate investment record can boost an application (this is not required). It shows the borrower knows the market and can execute their plan.

Lenders may ask for:

- Past projects: Tell them about properties similar to those you’ve worked with.

- Return on investment (ROI): Show them how successful your previous investments have been.

- Real estate knowledge: Do you have any certifications or special training in real estate? Let them know!

Essentially, lenders want to feel confident that you’ll use your loan wisely and be able to pay it back. Sharing your investment experience helps them do just that.

Financial and Legal Requirements

1. Proof of Funds

- Bank Statements: Recent statements showing strong cash flow and available funds.

- Investment Summaries: Demonstrate the value of your portfolio and your ability to leverage assets.

- Tax Returns: Verify your income history and financial stability.

- Financing option: Pay stubs, business financials, or anything that shows your money strength.

They need to know that you can make the required monthly payments.

2. Asset Details

- Purchase Contract: A copy of the agreement for acquiring your property.

- If renovations are planned, provide a detailed scope of work and any contractor bids.

3. Your Exit Strategy

A clear repayment plan is essential. Common exit strategies include:

- Sale of the Property: Generate proceeds from the sale to repay the loan.

- Refinance: Secure a new loan with better terms to repay the existing loan.

4. Using a Business Entity?

If you’re applying for [loan/grant/account] and your business is an LLC, we need the following…

- LLC Registration: Documents showing your LLC is properly registered and in good standing.

- Operating Agreement: Outlines the ownership and management structure of your business.

- Business Financials: Statements that showcase the financial health of your company.

Tips to Improve Your Loan Application In Irvine, CA

At CS Financial Group Inc., speed is vital in today’s fast-paced estate market. That’s why we have made our hard money loan application process simple. Include the step after:

Submit a robust application.

A complete and accurate application is crucial. Ensure all necessary documents are included and your financial information is presented.

This demonstrates your preparedness and commitment, enabling us to process your request swiftly.

Establish a legal structure (LLC)

Setting up your business as an LLC can show lenders you’re serious and organized.

It shows you built a strong legal base for your business, which can boost their confidence in lending to you.

But, it’s not a universal need for all loans. Many sole proprietors and partnerships also successfully get loans.

Present a clear exit strategy

Outline your loan repayment plan. Include your revenue sources and timelines.

A clear exit strategy shows you will meet your payment obligations. This builds lenders’ confidence.

Maintain open communication

Respond promptly to any inquiries and provide updates as needed.

Proactive communication fosters trust and transparency, ensuring a smoother and faster loan process.

Knowing hard money loan requirements is essential, but navigating the application process without obstacles is just as important.

Learn how to apply for hard money loans to ensure your real estate endeavors stay on track.

Frequently Asked Questions

How do hard money lenders assess a property’s “after-repair value” (ARV)? Does it affect the loan amount?

Lenders use appraisals, comparable sales data, and your renovation plans to estimate the ARV. The loan amount is often determined as a percentage of the ARV, typically around 60% to 80%.

What exit strategies do hard money lenders consider for fix and flip loans?

Lenders want to ensure you have a plan to repay the loan. Common exit strategies include: One is selling the renovated property. Two is refinancing into a conventional loan, and three secures long-term rental income.

How do hard money loan rates and fees compare to bank loans for investment properties?

Hard money loans carry higher interest rates, 8% to 15%, due to the increased risk for the lender. Rates can vary by lender, borrower, and loan terms. Traditional bank loans generally have lower rates but have stricter criteria.

What role does the loan-to-value ratio (LTV) play in a hard money loan?

LTV is a crucial factor. A lower LTV indicates a lower risk for the lender, potentially leading to better terms and interest rates. A higher LTV might require additional collateral or a higher interest rate.

Are there prepayment penalties for hard money loans if I repay early?

Some lenders may charge a fee for early repayment, while others have more flexible terms. It’s essential to clarify this upfront before accepting a loan offer.

With 20 years of hard money lending, certified mortgage broker Sandy Yuen has helped investors finance many projects. These include second homes, commercial properties, apartment buildings, and shopping centers.

She uses fix-and-flip, bridge, and construction loans to meet their needs. Sandy is a trusted lender in Irvine, CA. She is known for her fast approvals, flexible rates, and high transparency. She has served over 500 clients with over $450 million in funding.

Share This Story!

Local & National

While we are based in Southern California, our reach is national. For the exception of a few states, we have funded loans all across America in some of the largest and most active metropolitan areas.

We have also worked with clients ranging from local, national, to global, helping them secure the right loan for their project.

Ready to Start?

Let’s being the process with a complimentary consultation. As we specialize in custom hard money loan solutions for our clients, we want to better understand your specific needs in order to offer you the best program available.

Please fill our inquiry form to get the process started!